In the previous article, we became familiar with the basic pyramid scheme. This time, our eyes are on a very similar deceptive investment scheme, called Ponzi scheme (sometimes also referred to as the Ponzi pyramid).

People often think it’s just a type of pyramid scheme, and even use these terms interchangeably. That’s a pretty common misconception. It’s true that they share some similarities, but there are a few key differences that make a Ponzi scheme much more advanced and sustainable, compared to the classic pyramid fraud. Because of these superiorities, these schemes have the potential to grow much larger and sustain itself for decades.

If you haven’t read it already, you would probably be interested in reading the first part – What Is a Pyramid Scheme?

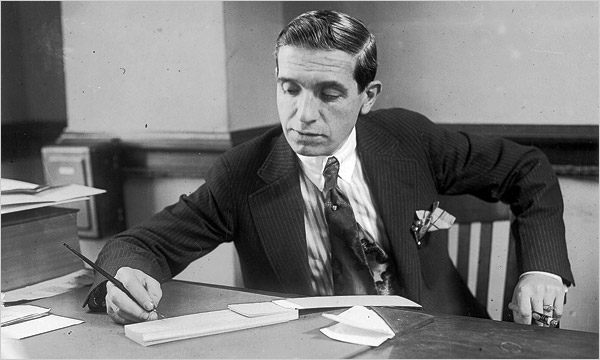

Man Who Made The Scheme Notorious

Anyone can pull off a simple swindle, but you have to be truly special in order to give your name to a certain financial scheme. And this man was…

Anyone can pull off a simple swindle, but you have to be truly special in order to give your name to a certain financial scheme. And this man was…

His full name was Charles Ponzi. He was born in Italy, in 1882. In 1903 (at the age of 21), he arrived in Boston on his own. By that time, all he had was $2.50 in his pocket.

“I landed in this country with $2.50 in cash and $1 million in hopes, and those hopes never left me” – later Ponzi told The New York Times. This attitude later led him to the creation of one of the greatest financial schemes in history.

He learned English, and at the very beginning was homeless. He took various odd jobs, including as a dishwasher in a restaurant where he slept on the floor. In 1907, he moved to Montreal and found a job as an assistant teller in newly opened bank Zarossi.

The bank was opened to cater the influx of new Italian immigrants arriving in the city. Zarossi paid about two times higher interest on bank deposits than competitors. This caused the rapid growth of the bank.

Charles Ponzi was talented and soon rose to the bank manager position. However, soon he found out that the bank has serious issues due to real estate loans. And those extraordinary interests were paid not from the profit on investments, but from the money deposited in newly opened accounts. The bank eventually collapsed, and Ponzi was left penniless. Nevertheless, as we’ll see this experience was very useful for him in the future.

Ponzi planned to return to the United States and start again but it was very hard, as he was broke. Then he tried to forge a bank check for $423.58 (more than $4600 today). (Keep in mind that at that time US dollar was much more valuable, that’s why that amount of money would be nearly 11 times higher in today’s terms!)

He cashed the check successfully, but shortly after was caught by the authorities and sentenced to three years in prison. Rather than informing his mother about this, he wrote her a letter, claiming that he had found a job at the prison.

After Ponzi was released in 1911, he finally returned to the United States. Shortly after got involved in yet another criminal activity, smuggling illegal Italian immigrants across the border into the US.

Immediately Ponzi was caught again, and spent another two years in Atlanta prison. (He also had an additional month added to his sentence due to his inability to pay a $500 fine.) After that, he was able to return back to Boston, where he met Rose Maria Gnecco. The two married in 1918.

Birth of The Term “Ponzi Scheme”

Ponzi again worked various jobs for several months, but these positions didn’t last long. He had the idea of selling advertisement, but this idea also didn’t work out.

One day he received a letter from a company in Spain asking about the advertisement. That letter contained an international reply coupon. Ponzi didn’t know what it is. After finding out the principle of how it works, he found one major flaw in the system which, theoretically, would allow him to make some serious profit.

The purpose of international reply coupons was to send them with the letters from one country to the correspondents in another country.

Then if a correspondent wanted to reply, he/she could exchange that coupon for postage stamp thus covering the expenses of sending the letter. In other words, coupons were sent so that addressees could reply without any expenses of their own.

The problem was that coupons were priced at the cost of postage in the country of purchase, and could be exchanged for postage stamps in a country where this price is much different. Ponzi’s idea was fairly simple. He understood that it’s possible to buy cheap international reply coupons in one country, and exchange them for way more expensive postage stamps in another country, where they can be later sold.

With this idea in mind, Ponzi quit his job, borrowed money, sent it to his relatives in Italy and told them to buy international reply coupons and send them back to him. Soon he ran into some difficulties with coupon redemption, but old dreams of becoming rich were far stronger than any obstacle in his way.

He began to look for investors and promised 100% returns in just 90 days! Claims like that were supported by theoretically possible returns from buying coupons cheaper and later selling postage stamps for way bigger price. The reality was a little bit different, but on paper, it looked amazing and believable, that was enough to allure new investors.

Ponzi quickly launched his own company – “Securities Exchange Company”. On the surface, everything seemed great. Everyone got their promised returns, the number of new investors increased exponentially, Ponzi was getting rich, and everyone was happy…

He hired agents to help him collect the money from all over the country. In February 1920, Ponzi’s net worth was about $5 000 (approximately $55 000 today), after only four short months, it increased to about $420 000 (nearly $4 600 000 today) in May! Very soon he fulfilled his dream and became a millionaire.

The former house of Charles Ponzi was recently listed for sale for 3.3 million.

People were investing their life savings and even mortgaging their homes. Most of them didn’t withdraw their returns but reinvested, which was very beneficial for Ponzi, because he didn’t need to pay any actual money. He just sent them false statements about their profits to keep them satisfied.

And of course, they were satisfied… They didn’t know that Ponzi actually did not generate any legitimate profit. The whole concept of a Ponzi scheme is based on payment of returns to the old investors with the money received from the new investors (almost like the pyramid scheme).

Sooner Or Later It Had To End

The whole thing quickly began to attract media attention and Ponzi became a celebrity. More and more investors entrusted their money to Ponzi. At his business prime, he reportedly made $250 000 (about $2 750 000 in today’s terms) a day!

He used to find hundreds of people, ready to give him their money, outside his office every morning. This kind of attention drew unnecessary suspicion of the authorities, various financial experts, and journalists. Ponzi probably knew that it cannot last forever and that his time is slowly coming to an end…

Very soon journalists naturally started to ask very difficult questions about this “magical” system. Scrupulous independent investigators were able to find out that Ponzi actually wasn’t investing with his company.

They also found out that in order for Ponzi to invest that much money and get so much profit, there should have been 160 million international reply coupons in circulation. In reality, there were only 27 thousand! Even more, the United States Post Office confirmed that coupons were not bought and sold in large quantities in the US or any other country.

All these and many similar uncertainties encouraged Ponzi’s investors to pull their funds out of the scheme. He unsuccessfully attempted to calm the enormous crowd of his investors by reassuring that everything is okay.

Despite that, they didn’t want to believe him anymore. Ponzi had several large bank accounts and bank managers began to worry that sudden withdrawal of his funds can damage the banking system.

The majority of his accounts became overdrawn and in combined, he was about $7 000 000 ($77 000 000 today) in debt. His accounts then were inactivated and Ponzi became insolvent. In total, his investors lost about $20 000 000, that’s more than $220 000 000 in today’s terms!

Ponzi was arrested on August 12, 1920, found guilty as he was unable to cover the damage, and was imprisoned again. Later he tried various other scams, but none of them worked out, and he was caught each time.

Ponzi spent 22 total years of his life in prison, 17 of which were for fraudulent scams. His wife Rose divorced him in 1937. Ponzi spent the rest of his life in poverty. His health deteriorated. At the end of his life, he was almost blind, and the right side of his body was paralyzed.

Ponzi died in Rio de Janeiro charity hospital on January 15, 1949. In his last interview he said “Even if they never got anything for it, it was cheap at that price. Without malice aforethought, I had given them the best show that was ever staged in their territory since the landing of the Pilgrims! It was easily worth fifteen million bucks to watch me put the thing over.”

Ponzi had a really amazing potential. Most importantly, he had dreams and he was ready to fight for them. He had what it takes to become rich. If he would have chosen another path, he would have become a really successful businessman. It’s sad to see how very promising people sometimes decide to do not very respectable things…

Pyramid Scheme vs. Ponzi Scheme

As I mentioned earlier, Ponzi schemes are often associated with pyramid schemes. In both of these types of scams naive individuals, who want to make quick money or believe in the possibility of getting rich quick, are fooled by clever manipulators who promise extraordinary returns.

Unlike legitimate investment systems, these schemes can provide investors with profits and sustain itself, only as long as the number of investors increases and monetary outflows can be outweighed by inflows.

In both cases, the initial deceiver is on the top of continuously increasing rungs of investors, but there are several aspects that separate these two systems.

As you’ve already understood, Ponzi schemes are based on deceptive investment management services, and it’s the type of securities fraud. In this scheme, investors are led to believe that they have the chance to invest in some type of mysterious investment opportunity.

They are not asked to do anything more than just give their money to the person or organisation running the scheme. Schemers claim that they are going to take care of everything else. Of course, investors’ funds will never be actually invested.

When those investors declare their willingness to withdraw their funds, they are paid with incoming funds from later investors. Furthermore, Ponzi schemes can sustain itself for far longer than pyramid schemes, as they don’t fully rely on the exponential growth of the number of investors.

If returns are not very high, the number of investors can remain relatively low. And it’s very convenient if an investor decides to reinvest his/her money expecting even higher returns.

On the other hand, when a person gets involved in a pyramid scheme, it requires more work. In fact, a person is just paying for the opportunity to make money on his/her own.

On the other hand, when a person gets involved in a pyramid scheme, it requires more work. In fact, a person is just paying for the opportunity to make money on his/her own.

This type of scam is orchestrated so that the initiator must recruit investors who then must continue to recruit other investors on their own, and those others must recruit even more people and so on… Until there are not enough people willing to join and scheme eventually collapses.

If you fail to recruit new members, you fail to make money. The receiver of the money often must share the profits with those at the higher levels of the pyramid.

Quite often pyramids are disguised as legitimate multi-level marketing companies. In this case, participants pay to the recruiter for an opportunity to sell often overpriced products that have no demand of the market. Pyramid schemes always fully rely on the exponential growth of the number of new participants.

In both of these practices, the only guilty party is considered to be the initiator of the scheme. Some earlier victims actually can make money with these schemes. Although, in this case, they probably cannot be considered as victims.

There are some ethical questions about whether or not these lucky participants should help compensate the damage made for not so lucky ones.

Top 3 Biggest Ponzi Schemes That Ever Failed

Charles Ponzi didn’t invent this concept, he wasn’t the first man who implemented the scheme. It was just the first big case that stood out among others. But very far from the biggest.

The reason I say “biggest Ponzi schemes that ever failed,” is that many more of them are executed by very intelligent entrepreneurs who know what they’re doing, so they are able to bypass the laws and avoid the attention of authorities.

New Ponzi schemes are constantly discovered and who knows how many more of them are successfully operating as you read these words. Only God knows how big some of them are. Anyway, here are the top three biggest Ponzi schemes that are no longer running. (By biggest, I mean that the most money was lost.)

3. Allen Stanford

Robert Allen Stanford was running a Ponzi scheme for about twenty years, and it was based on selling certificates of deposit.

He managed to defraud more than 21 000 people from 113 countries. In combined they’ve lost $7.2 billion. However, Stanford kept the more money for himself than any other known Ponzi schemer ever.

He stole approximately $2 billion, which earned him a place on Fobes’ list of the richest people in the world. He loved luxurious life, had yachts private jets, cars, etc. When his theatre began to fall apart, he started bribing regulators and auditors.

In 2012 he was found guilty of conspiracy to commit wire fraud and obstruction, and sentenced to 110 years in prison with 5.6 billion personal fine he will never be able to pay.

2. Ezubao (Chinese Finance Company)

Ezubao was a lending scheme based in the eastern Chinese province of Anhui. People were told that their money will be given to borrowers and later repaid with interest as high as 15%.

It started operating as an online company in July of 2014, and unexpectedly stopped it’s operations in December of 2015. The company was operating just a very short period of time – only 18 months, but in the meantime managed to defraud nearly a million people, who gave them over $7.6 billion!

Chairman Ding Ning, reportedly recently spent $150 million on luxury stuff. In February 2016, the company was completely shut down, and all 21 perpetrators had been arrested.

The funny fact is that when trying to hide all evidence, they put important documents in bags and buried them 6 meters (20 feet) underground. Police managed to dig these documents up after twenty hours of work with two excavators.

1. Bernie Madoff

This man started the scheme back in 1986 and continued it for 22 years until 2008. This was the largest Ponzi scheme ever revealed. At one point, his fictitious hedge fund managed around $65 billion!

He actually wasn’t very greedy and kept only $250 million to himself. There was a suspicion as early as 1992, but he was never caught, mostly because he was a very respected figure in the finance world and earned the trust of his investors.

He ran several legitimate businesses and helped found the NASDAQ stock exchange. Unlike most other scammers, he didn’t promise high returns, although they were unusually consistent.

In 2008, more investors than ever before requested their funds, and he himself confessed his crimes. His life was ruined, both of his sons have died: one from a medical condition, and the other committed suicide. His wife stopped talking to him.

In 2009, Madoff pleaded guilty to 11 federal felonies, including securities fraud, mail fraud, money laundering and perjury. He later said he was astonished by the fact that the Securities and Exchange Commission (SEC) failed to catch him. He’s now serving a symbolic sentence of 150 years in Raleigh, North Carolina.

Be Careful!

Ponzi schemes are really hard to spot. They can be covered up as any kind of investment. As you can see, recently collapsed several really massive ones. It gives a reason to believe that there are many more of them out there.

Also, it’s frightening that some of them are carried out by really brilliant and respectable businessman. When it comes to investments, you actually can never fully trust anyone. However, if you are careful and thoughtful enough, in most cases, you can effectively avoid Ponzi schemes.

Of course, the first red flag is unrealistic promises. If someone is trying to tell you that this is the next big thing, that they have found some kind of special investment strategy or algorithm, they are almost always lying.

If someone is trying to pressure you into investment, it’s one more sign that something might not be right. The decision to invest money should be well thought out.

If you are planning to invest, carefully examine what information does the company provide. If there’s too little details, this is also a really big red flag. Unfortunately, positive testimonials of other clients do not necessarily mean that the company is legit. Some of the participants actually make money with Ponzi schemes, and from their perspective, everything seems great.

And finally, for smart individuals, there shouldn’t be the end of the world if they become victims of a Ponzi scheme. The thing is, that every reasonable investor always diversifies his portfolio.

People should invest in several different industries with several different companies. In this case, there’s nothing bad if you unexpectedly invested in a Ponzi scheme, the worst thing that can happen is that you can lose a quarter of your portfolio, or even less.

Thank you very much for reading!

If you have some thoughts, please leave them in the comments 🙂 I would love to hear any kind of feedback as well!

-Grey

Very informative, thank you!

Thanks!

Nice work, but you need to post more if you want to become more successful.

Thank you for your comment. I’ve been really stressed out recently, but it’s ok now. I’m definitely going to post more 🙂

You really put a lot of work in your posts! Very nice website. I can see a bright future for you!

Thank you for your comment. Yes, I really do, it took me about 14 hours to write this post. I hope I’ll get more visitors over time 🙂